What the AgTech Industry can learn from Zoom, a Global Pandemic, and the U.S. Economy.

By Steven Valencsin, CEO, Growers

If there is anything to be learned from the pandemic of 2020, it may be that “timing is everything.” It’s a simple yet profound notion that rings true—especially within precision agriculture.

Let me explain.

Before the pandemic, Zoom (a company that needs no introduction) was logging 10 million daily meetings in December 2019. Four months later, during the initial peak of COVID-19, there were over 300 million daily Zoom meetings occurring worldwide. As many industries were struggling to stay afloat during 2020, Zoom was pushed to the top of their industry category. But, what if Zoom wasn’t poised from a product, marketing, and sales standpoint to take advantage of this opportunity? Success is where opportunity and preparation meet. Meaning, if Zoom didn’t have the brand awareness, infrastructure, sales, and support systems in place to handle this type of growth, I assure you, the word “Zoom” would not be so colloquial as it is today.

So, how does Zoom’s story relate to precision agriculture? It all starts with the relationship between the commodity markets, the U.S. economy, and technology adoption.

The Important Relationship Between the U.S. Dollar and Commodity Prices

You may (or may not) be aware that the U.S. economy often has an inverse relationship with U.S. farming and ranching. That is, when the U.S. economy is booming, farming is typically struggling. As we’ve seen economic indicators rise over the past 4 to 5 years, U.S. farmers and ranchers have been experiencing nothing short of their own recession. While this may be shocking to hear, it’s not a new phenomenon.

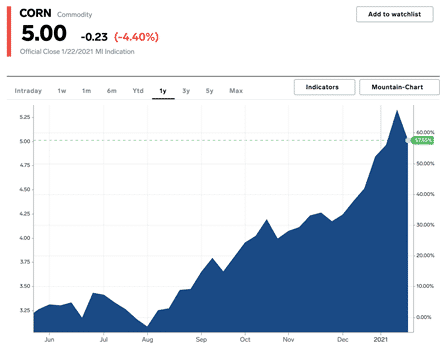

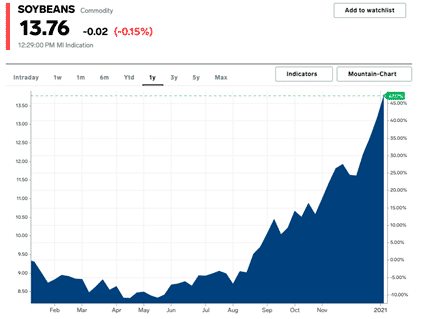

Commodity prices have historically dropped when the dollar strengthens against other major currencies. In the economic collapse of 2008, commodities like corn and soybeans began a 7-year streak of higher than average prices. There was a minor hiccup in 2010-2011, but corn peaked in 2015 at $6.96/bushel and soybeans peaked at $17.94/bushel in 2012. Those were the “glory years” of farming. As the U.S. dollar value began to rebound in 2015, we saw a steady decline in crop prices for the next five years.

Why this inverse relationship? In the article, How the Dollar Impacts Commodity Prices, by The Balance, the author explains: “The dollar is the benchmark pricing mechanism for most commodities. U.S. currency is the reserve currency of the world. The dollar tends to be the most stable foreign exchange instrument, and most other nations hold dollars as reserve assets. When it comes to international trade for raw materials, the dollar is the exchange mechanism in many, if not most cases. Therefore, when the value of the dollar drops, it costs more dollars to buy commodities. At the same time, it costs a lesser amount of other currencies when the dollar is moving lower.”

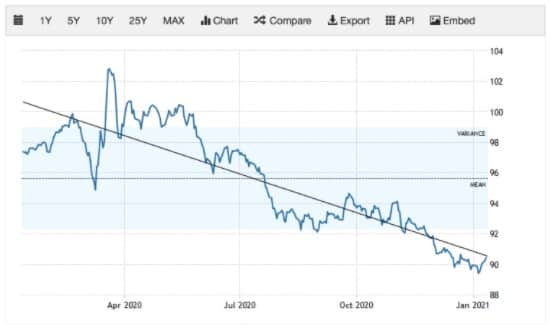

If you’ve been reading the U.S. Economic headlines, you’ve noticed that the U.S. dollar value has been dropping steadily since the spring of 2020—and even more rapidly since late Q3 2020 (see Figure 1). Conversely, commodities like corn and soybeans have gone in the opposite direction and, at some times, nearly straight up (see Figures 2 and 3).

Figure 1. Declining U.S. Dollar Index

Figure 2. Increasing Corn Prices

Figure 3. Increasing Soybean Prices

You may be interested in:

Agtech solutions make agriculture more sustainable

Osmocote5 – Controlled release fertilizer technology

Digital Solutions in Agriculture – advancing global food security

Where Opportunity Meets Preparation

Technology adoption is a real struggle within agriculture; however, much of this is primarily due to timing. There has been an explosion of new technology available to farmers and ranchers within the past 5 or 6 years—unfortunately during one of the worst economic times in agriculture. The financial challenges have significantly curbed the farmer’s appetite for taking a financial risk by adopting new technology. And this makes sense—where there is less disposable income, there is less inclination to take risks.

Fortunately, there is an obvious indicator that this environment is about to change drastically.

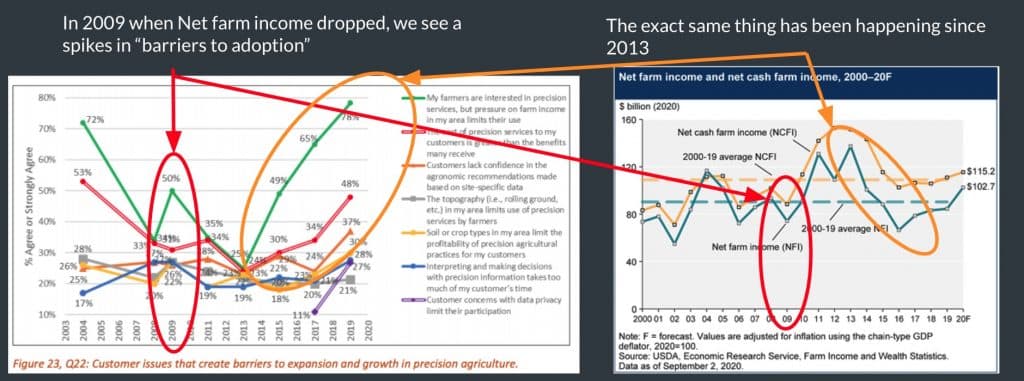

Figure 4 shows that when Net Farm Income (NFI) drops, Barriers to Expansion and Growth in Precision Agriculture increases. This example is the most pronounced around 2015, where you see a noticeable decline in NFI and a corresponding increase in all of the barriers limiting precision agriculture expansion. Notice that the number one reason preventing adoption is “pressure on farm income in my area limits adoption.”

Figure 4. Net Farm Income vs. Barriers to Expansion and Growth in Precision Agriculture

A Window of Opportunity is About to Open for Farmers and the AgTech Industry Alike

All of this data points to a profound opportunity for the Ag-Tech industry as we begin to see the barriers to technology adoption decrease and usage increase. I anticipate seeing this rebound starting in late 2021 and taking full effect in mid to late 2022. It is likely to take a full two years to recover from a difficult half-decade. Many farmers have been operating at or below break-even and doing whatever they can to survive. Farmers will use this time to pay down debt, rebuild depleted cash reserves, and position themselves for the next time the markets take an unfavorable turn. Farmers who have weathered the past storm are stronger, wiser, and more open to technology’s value and use it to their advantage to overcome the next crisis.

For the AgTech industry solution provider, it’s imperative their technology systems be ready for the spike in adoption rates. Remember, “timing is everything.” The time you’ve spent refining product features, performing customer/competitive research, leveling up your marketing and sales efforts is preparing you for when the market is “open and ready to receive.” Equally important are the customer support resources AgTech companies will need to champion farmers through this exciting technology expansion wave.

I would love to hear what you think about these trends and predictions. Please leave your comments below.

About Growers:

Growers is the data and technology company that works for all of agriculture. Everything we build is designed to empower the entire agricultural community to know better and grow better every day. As a SaaS technology leader, Growers is delivering innovative customer management tools to ag professionals, allowing them to offer better, more sustainable farm planning and treatment solutions to their customers.