The next wave of foodtech trends is emerging with more focus, more discipline, and far stronger alignment with real-world needs. After years of experimentation, big promises, and rapid iteration cycles, foodtech 2026 is shaping up to be a year where credibility matters more than charisma. The future of the foodtech industry is being defined not by “what’s the boldest idea,” but by “what actually works, not only nutritionally, but economically, and at scale.”

The sector is shifting from pure disruption to refinement. Core trends in foodtech now revolve around responsible scale-up, cleaner and more functional ingredients, and meaningful progress in circularity. At the same time, companies are doubling down on innovative solutions in food tech that improve nutritional value, reduce waste, and strengthen food system resilience without adding complexity or cost.

Importantly, this maturation is extending beyond protein alone, as FoodTech increasingly focuses on functional ingredients and preventive nutrition designed to support long-term health outcomes.

In short, FoodTech isn’t slowing; it’s maturing. The foodtech solutions shaping 2026 are sharper, more biologically grounded, and built around technologies that can move from the lab to the market with confidence.

Trend #1 – Alternative Proteins Reset, Not Retreat

Alternative proteins aren’t disappearing, they’re recalibrating. The funding slowdown has pushed the category into a far more disciplined, science-driven phase, making it one of the most important foodtech trends shaping 2026. Consumer preferences continue to shift toward cleaner, more sustainable protein sources, but the market is no longer rewarding broad promises. Instead, it’s rewarding ingredients that actually work.

The most meaningful progress is happening in fermentation-led ingredients: proteins designed for specific functionality such as emulsification, gelation, or nutrition enhancement. These targeted ingredients are proving more resilient than branded plant-based products because they solve real formulation challenges for food manufacturers. They also align with the future of the foodtech industry, which is leaning toward B2B ingredient supply rather than consumer-facing meat analogues.

At the same time, protein is no longer the sole center of gravity, as functional and health-oriented ingredients are emerging as equally important drivers of FoodTech growth heading into 2026.

Another clear shift is the rise of hybrid approaches, combining plant-based, fermented, and early cultivated inputs to achieve better taste, cost, and scalability. This pragmatic pathway is giving companies room to create innovative solutions in food tech that feel more familiar to consumers while reducing risk for manufacturers.

In short, alternative proteins aren’t retreating. They’re maturing. And the companies that focus on functional performance, cost-in-use, and credible science will shape the next generation of foodtech solutions moving into 2026.

Trend #2 – The Rise of Shared Fermentation Platforms

Fermentation has always been fundamental to food production, but in foodtech 2026, it shifts from standalone assets to shared, modular platforms. This is one of the clearest foodtech trends emerging from the market: companies no longer need to raise capital for dedicated fermentation plants. They plug into existing infrastructure and focus resources on strain development, functionality, and cost-in-use.

From your original text, this remains true and important to keep: fermentation is a natural process. What has changed is the operating model. AI and computational design now identify viable proteins in days, not months, supporting a new wave of B2B ingredient companies supplying fermented proteins and functional materials across the value chain.

Shared fermentation capacity solves two real constraints:

- The high cost of scale-up, and

- The long cycle times between discovery and commercialization.

The science itself hasn’t changed—fermentation remains a natural, reliable process—but the operating model has. Artificial intelligence and advanced computational tools now identify promising proteins in days, enabling a new wave of B2B ingredient companies focused on precision-fermented proteins, lipids, and functional materials that strengthen the future of the foodtech industry.

Shared fermentation capacity addresses two major constraints:

- High costs and long timelines for scale-up

- Slow transitions from discovery to market-ready ingredients

It also stabilizes supply chains. Precision-fermented ingredients don’t depend on weather, land, or biological risk, making production more predictable and resilient, an increasingly important factor as manufacturers seek dependable foodtech solutions.

Throughout 2026, strategic partnerships between biotech innovators and established food companies are expected to accelerate. Shared platforms reduce barriers to entry, shorten pilot cycles, and allow products to reach commercial validation faster. This is platformization in practice: more efficient, more collaborative, and far more aligned with how modern food manufacturing actually operates.

In short, precision fermentation is moving into its most scalable phase yet, lean, connected, and purpose-built for the industry’s next decade.

Trend #3 Cultivated Protein Breakthroughs Meet Regulatory Crossroads

Cultivated meat and seafood have made undeniable scientific progress over the past decade, and 2026 is the year that science and regulation collide. This is one of the most important foodtech trends to watch, not because cultivated proteins suddenly scale, but because the rules governing them are moving in opposite directions across global markets.

On the breakthrough side, regulators in Australia approved Vow’s cultivated meat, and the U.S. FDA issued a “no questions” letter for cultivated salmon, clear signals that the category is scientifically credible and edging toward mainstream food production. These milestones validate years of work in cell-line optimization, media cost reduction, and scalable bioprocess design. They also reinforce how rapidly innovative solutions in food tech are maturing.

But progress isn’t uniform. Several U.S. states advanced bans on lab-grown meat, creating a fragmented regulatory landscape that food producers must now navigate. Instead of a single path toward commercialization, the industry is facing a patchwork, one that rewards companies able to adapt quickly and operate across multiple regulatory environments.

What we’re seeing isn’t a retreat; it’s a divergence. Cultivated proteins are moving forward, but the future of the foodtech industry will depend on the regions willing to support innovation with clear, science-based frameworks. 2026 will likely be the year where cultivated meat either accelerates through strategic partnerships or stalls in markets where regulation becomes a long-term barrier.

As with most foodtech solutions gaining traction today, the winners will be those who can balance technological readiness with regulatory sophistication.

Trend #4 Turning Waste Into Value

One of the most grounded and commercially relevant foodtech trends heading into foodtech 2026 is the shift toward circular processing, not as a sustainability slogan, but as a cost, carbon, and product-development strategy. The math is straightforward: nearly one-third of all food produced is wasted, and every point of inefficiency adds pressure to supply chains, margins, and emissions.

This is why waste-to-value technologies are gaining momentum. Brands are now upcycling agricultural and food-processing side streams into functional ingredients; fibers, emulsifiers, and natural texturants that slot directly into clean-label formulations. These aren’t speculative ideas; they’re innovative solutions in food tech that reduce waste, improve ingredient sourcing resilience, and support more transparent product stories.

The driver is simple: consumers want cleaner labels, and producers want ingredients that perform without adding cost or complexity. Upcycling solves both. It also builds a circular mindset within R&D, pushing companies to see every by-product as a potential input rather than a disposal challenge.

For companies shaping the future of the foodtech industry, circular processing is becoming a credible business lever. More efficient use of raw materials, lower carbon footprints, and new revenue streams from by-products are turning waste-to-value systems into practical, scalable foodtech solutions.

2026 is likely to be the year circularity moves from aspiration to operational reality.

Trend #5 — AI Transforms R&D and Quality Assurance

AI is stepping into 2026 as the quiet infrastructure powering the next wave of foodtech trends, not flashy, not speculative, but deeply operational. For the first time, AI is embedded across the entire R&D stack: formulation search, sensory modeling, ingredient performance prediction, contaminant detection, and end-to-end traceability.

This shift is reshaping the future of the foodtech industry. Instead of lengthy, trial-heavy development cycles, food and ingredient companies are leaning on machine learning to test thousands of possibilities in hours, not months. AI systems can now model texture, analyze flavor interactions, predict stability issues, and simulate regulatory scenarios, all before a physical prototype exists.

These are the innovative solutions that quietly move the food tech sector forward. They reduce waste, lower development costs, and give scientists a level of precision that simply wasn’t possible a few years ago. It’s also accelerating progress in areas like fermentation-derived ingredients and alternative proteins, where iteration cycles determine competitiveness.

For quality assurance, AI is becoming indispensable: real-time contaminant detection, automated anomaly spotting, and predictive shelf-life monitoring are evolving from “advanced tools” into baseline expectations. As companies look for smarter solutions that strengthen compliance and protect brand trust, AI delivers measurable value.

If earlier phases of FoodTech were defined by ambition, FoodTech is now defined by accuracy. And AI, grounded in data, not hype, is the technology making that possible.

Trend #6 — Functional Ingredients and Preventive Nutrition

As FoodTech moves toward 2026, innovation is expanding beyond alternative proteins into functional ingredients designed to deliver specific health benefits. Ingredients supporting gut health, metabolic function, cognitive performance, women’s health, and healthy aging are seeing growing demand from both consumers and large food companies seeking differentiation grounded in science rather than marketing claims.

What defines this trend is precision. Functional fibers, bioactives, minerals, and postbiotic ingredients are increasingly developed with clear mechanisms of action and measurable performance. Rather than creating entirely new product categories, companies are embedding health functionality into familiar foods, making preventive nutrition more accessible and scalable.

Closely related is the convergence of food, supplements, and healthcare systems. Medical nutrition, personalized dietary interventions, and clinically supported ingredients are moving into the mainstream, driven by rising healthcare costs and greater emphasis on prevention. For FoodTech, this reinforces the shift toward B2B ingredient platforms that can meet regulatory expectations while integrating seamlessly into existing food manufacturing systems.

FoodTech 2026: From Big Promises to Better Systems

If 2024 and 2025 were years of experimentation, 2026 is the year of execution. What defines the next chapter is not the search for “the next big thing,” but the ability to refine, scale, and integrate. The most meaningful trends in foodtech, alternative protein resets, platformized fermentation, regulatory inflection points, waste-to-value ecosystems, health-driven functional ingredients, and AI-driven R&D are all converging toward a single theme: make what works, work everywhere.

This next wave will be built on innovative solutions in food tech that are smarter, cleaner, and more financially disciplined. It will be shaped by tighter collaboration between startups, corporates, scientists, and regulators. And it will reward those who take the time to understand the science, respect unit economics, and build with long-term resilience in mind.

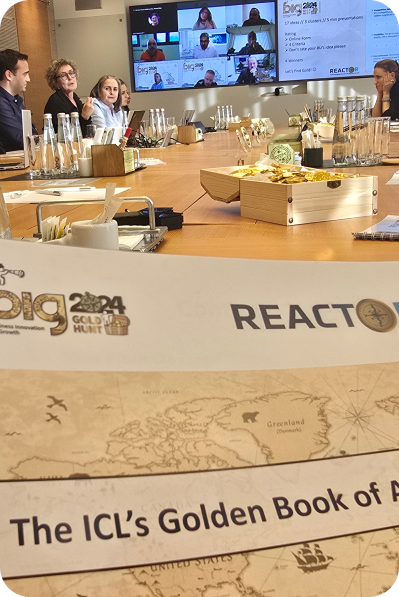

ICL continues to play a role in this transition by supporting technologies and founders who are grounding innovation in real-world performance, and by advancing foodtech solutions that strengthen sustainability, improve ingredient functionality, and support global food security.

2026 won’t be defined by disruption for its own sake. It will be defined by precision, credibility, and the quiet systems that make real change possible.