2026 is set to become a transitional year in the field of climate tech innovation and investment. Climate tech is no longer a niche sector or even the “wild west of green investment”. It’s an established discipline that attracts both specialist venture capital and, increasingly, general investors.

Clean energy and low-emission technologies represent a significant market, attracting capital in excess of $2 trillion annually. One of the most important climate tech investment trends is that capital is becoming more selective, and investors are applying sharper metrics.

Scale is going to become even more of a determining factor in 2026. In a tighter and more realistic market, projects that can demonstrate viability, durability, and impact will enjoy a powerful advantage. Investors are shying away from moonshots and are demanding measurable transformation and strategic impacts.

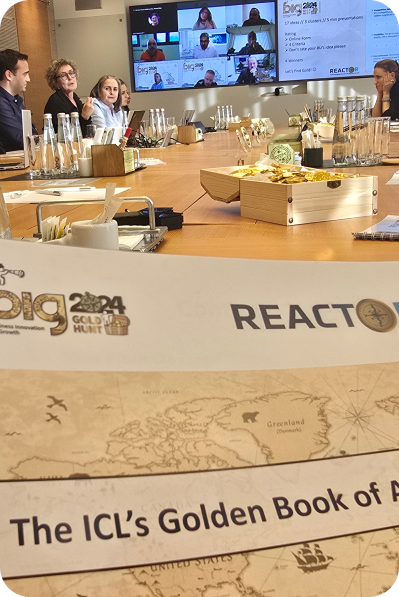

As well as developing innovative solutions in climate tech, ICL and its partners are pioneering disruptive technologies in key sectors like energy storage, sustainable materials, and agtech resilience that are directly shaped by these dynamics. This article gives a useful overview of five major climate tech trends that will define innovation and investment in 2026.

As climate tech enters a more disciplined phase, the forces shaping the sector are no longer abstract or emerging; they are clearly visible. Capital is flowing with greater selectivity, policy is exerting a stronger and more direct pull, and scale has become the primary test of credibility.

These shifts are already determining which technologies advance, which business models endure, and which projects secure long-term backing. The trends that follow reflect how climate tech is operating in 2026: fewer moonshots, sharper filters, and a decisive shift toward execution over experimentation.

Trend #1: Energy-Transition Finance Broadens and Deepens

The first defining climate tech trend of 2026 is not technological; it is financial.

The original climate tech investment ecosystem was largely built around renewables and electric vehicles. The sector has widened and matured and now offers a diverse range of potentially lucrative investment opportunities, including grid and storage infrastructure, carbon removal technologies, and industrial decarbonization solutions.

As previously mentioned, combined global energy investment in clean energy technologies is topping $2 trillion annually. This represents a new record for a relatively young sector. The situation is extremely positive, but it shouldn’t be confused with an investment boom. The overall atmosphere is one of cautious pragmatism, with fewer speculative ventures and an emphasis on blended finance and (meticulously costed) project-based structures.

This is a financial landscape that suits corporate venture capital programs. Corporations are leveraging existing expertise and resources to identify opportunities in alignment with their own long-term vision. They are stepping into the gaps left by increasingly cautious VC markets to forge strategic industrial partnerships with founders and startups.

What this signals is the mainstreaming of climate tech. In 2026, its technologies will become increasingly central to national industrial policy and corporate strategies.

Trend #2: Hydrogen’s “Pipeline Cleanup”

In 2026, hydrogen remains strategically important, but only after a necessary reset.

For a number of years, green hydrogen was touted as the future of clean energy. As the realities of current tech limitations and scale kick in, the ‘hydrogen hype’ has begun to diminish, and the global project pipeline that emerged around green hydrogen initiatives is contracting. Green hydrogen still has enormous future potential as an alternative energy source, but investors are seriously reappraising the sector and adjusting funding criteria.

Many early announcements lacked offtake certainty, infrastructure clarity, or bankable economics. During a period when there was an abundance of venture capital, a high appetite for risk, and an enthusiasm for hydrogen energy initiatives, the market favored founders. In 2026, the majority of projects that gain funding will demonstrate clear demand anchors, genuine policy alignment, and integrated value chains.

Hydrogen-based climate tech innovation is already delineating on a regional basis. Europe and Japan are continuing targeted support for the sector, while the US continues to offer IRA incentives for development. Export ambitions among key Middle Eastern innovators are also sustaining momentum.

Although green hydrogen production hasn’t met optimistic early projections, 2026 points to a leaner and more credible hydrogen landscape, an overdue correction toward a functional hydrogen economy.

Trend #3: The AI-Electrification Demand Shock

In 2026, energy demand, not energy supply, is emerging as one of climate tech’s defining constraints.

One rapidly emerging climate tech trend that is likely to dominate strategic thinking in 2026 is how to address the demand for energy from power-hungry AI and data centers.

The (largely) unanticipated rise of these high-tech energy consumers is quietly reshaping the energy equation. The challenge facing energy innovators is how to adapt existing grids to new demand surges and reduce grid stress without compromising on clean energy objectives. Even renewables-rich regions require a high level of innovation to meet rising demands.

2026 is going to see a renewed focus on energy efficiency and investment in flexible solutions for demand management. The key to a more resilient grid system that meets the surges in demand generated by AI and data centers will be large-scale energy storage facilities.

There are exciting opportunities for companies that can deliver improvements in battery materials or develop optimized thermal management systems and new grid software. Businesses that can position themselves as energy enablers will benefit from the increased demand placed on grids. The convergence of AI and energy is expected to define climate tech’s next major challenge – the need to blend digital and physical infrastructure.

Trend #4: Manufacturing and Supply-Chain Localization

In 2026, where climate technologies are manufactured is becoming as strategically important as the technologies themselves.

One trend with fascinating long-term implications is the move to locate manufacturing centers and supply chain hubs closer to consumer bases. Major policy initiatives like the US Inflation Reduction Act and the EU’s Net-Zero Industry Act are mandating and incentivizing a fundamental reshaping of supply chains. The concepts of energy independence and energy security are being increasingly integrated into national policy.

The requirement to process battery materials, solar components, and critical minerals closer to end markets is reshaping how companies do business. The concepts of geopolitical risk reduction and strategic resilience are increasingly key features of corporate planning. This new focus is balanced by a need to monitor “policy durability”. Investors and corporations need to evaluate how long government incentives and directives will remain viable amidst changing political landscapes and trade pressures.

Climate tech companies need to pay close attention to how this trend evolves in 2026 and internalise the idea that localizing manufacturing goes beyond transitory compliance demands. Effective localization functions as a competitive bastion that offers better control over quality, and a reduction in carbon footprints and overall costs. The political and economic assumptions that drove globalization are looking increasingly shaky, and the coming years will be a good time to center operations close to major markets and consolidate for greater resilience.

Trend #5: Climate Change Adaptation Becomes Investable

Climate tech’s next phase is being shaped as much by resilience needs as by emissions targets.

Until recently, climate tech focused on mitigation. The prevailing political imperative was to cut, or completely eliminate, greenhouse gas emissions, and innovators developed technologies within this policy framework. In parallel with climate mitigation initiatives, a new focus on adaptation and resilience is emerging. The mainstream investment environment lens is increasingly focused on identifying solutions that span water technology, fire and flood analytics, and agricultural resilience.

There is a pressing need to feed a growing global population and achieve lasting food security in the face of extreme weather events and increasingly challenging growing conditions. Innovators who offer agricultural resilience can attract investment capital or negotiate favorable strategic partnerships with corporate backers. Investors are becoming cognizant that the narrative is expanding from “net zero” to “climate readiness” and are ready to explore resilience technologies that can range from drought-resistant seeds to AI-powered digital agronomical platforms or state-of-the-art irrigation systems.

This new reality is creating opportunities for companies to make a significant impact on the global food supply chain and to innovate for greater stability in a period of global warming and increasingly frequent extreme weather events. The quality and scope of climate resilience technologies will define how societies thrive under new – and often unpredictable – environmental conditions.

Climate Tech’s Reality Check: 2026 Outlook

The climate tech sector is undergoing a transitional period, but it is a necessary transition and one that promises positive outcomes. Although the first half of 2025 saw global VC investment plateau, sentiment is improving as IPO windows reopen and exits reappear. The underlying feeling is that the climate tech sector is maturing and is becoming firmly established as a mainstream sector that investors can navigate effectively. 2026 will see fewer dramatic headlines and extravagant predictions, but more milestones and tangible achievements.

If 2026 produces a salient theme in climate tech, it will be a functional balance between innovation and execution, and greater harmony between global ambition and local grounding. There will also be a vital and timely expansion from climate mitigation to climate adaptation and resilience.

Companies like ICL that can align science, capital, and an incisive strategic vision will define the future of climate technology.